One stock to buy and one to avoid / How Bud Light Blew It / Fed rate cut(s) later this year / Netflix's 2002 IPO / Greetings from Kenya

1) If you missed our big event yesterday, here's one more chance to watch.

In it, my friend Louis Navellier and I predict a powerful shift is coming to the market... And we explain how a single investment could make you 5 to 10 times your money as it unfolds.

We also share a free stock recommendation (and ticker symbol) to take advantage as this story unfolds, as well as a popular stock to avoid.

2) Wow, this is a new risk factor companies have to consider that I hadn't really been paying much attention to...

Pretty much every day in recent years, I've read a story about some activist group (both far left and far right, in roughly equal numbers) calling for a boycott of some company, usually for some really stupid reason.

Generally, the company ignores the activists or tells them to go jump in a lake, the boycott goes nowhere, and everybody soon forgets about it.

But that's not what happened in the case of the best-selling beer in America, Anheuser-Busch InBev's (BUD) Bud Light, as this in-depth Wall Street Journal article notes: How Bud Light Blew It. Excerpt:

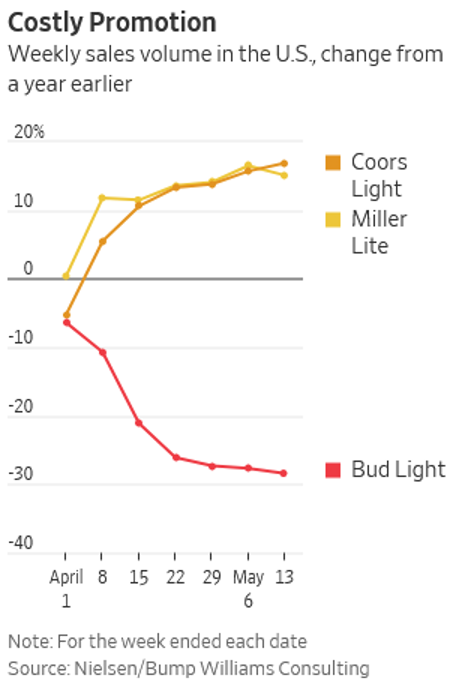

Then, a promotion with transgender influencer Dylan Mulvaney prompted a boycott.

This wasn't the first time an Anheuser-Busch brand had supported transgender rights in a marketing effort: In 2021, Michelob Ultra featured transgender track star Cecé Telfer in an ad campaign supporting gender equality in sports. Last year, Bud Light Canada released a limited-edition can for pride month displaying pronouns such as she, he and they. "Celebrate everyone's identity," the can said.

But senior executives said they were caught off-guard by the Mulvaney promotion and the personalized beer can. AB InBev's leaders were uncomfortable with a marketing initiative that thrust one of its biggest brands into the middle of a divisive political issue, according to people familiar with the matter.

The company's response made matters worse. Anheuser-Busch stayed mostly silent for two weeks, then released a general statement about bringing people together, prompting criticism from all sides for both waiting too long to respond and also not taking a clear stand.

When the furor continued, the company placed Heinerscheid and her boss, Daniel Blake, on leave. Heinerscheid was replaced in the role of head marketer for Bud Light by a seasoned beer executive and Blake's role was eliminated to give senior marketers closer oversight on brand decisions. Heinerscheid and Blake remain on leave. Anheuser-Busch declined to comment on their future at the company, citing the executives' privacy and safety.

The result angered pretty much everyone: core Bud Light consumers, supporters and opponents of transgender rights, wholesalers, retailers, bar owners and company staff.

As a result, Bud Light's sales have fallen by nearly 30%, as this chart shows:

We'll be feeling the shockwaves from what's happened here from years to come.

And for those celebrating the power of customers to rein in what they perceive to be overly "woke" corporations, keep in mind that this could easily happen to a company that offends those on the left.

3) My view that the Fed would cut rates by 0.25% twice by the end of the year was shared by the market earlier this month.

But now, the consensus view is that there will only be one cut, with the second not coming until early 2024, as this chart shows:

My view remains unchanged, but I'm monitoring this closely, as markets will be very much affected by how quickly the Fed cuts interest rates.

4) Yesterday was the 21st anniversary of Netflix's (NFLX) IPO. Here's a tweet about it:

But you didn't need to invest at the IPO to make a fortune...

In December 2011, when I was betting against the stock, I had a back-and-forth with then-CEO Reed Hastings, which I covered in my April 5 e-mail. By the following October, the concerns I raised had come to pass and the stock cratered from (split adjusted) $43 to under $8.

On the very day it bottomed at $7.78, October 1, 2012, I pitched it as my favorite stock idea to the 500 attendees of my Value Investing Congress and, immediately afterward, on national television on CNBC, saying it was this decade's Amazon (AMZN), which had risen 20-fold in the previous decade. (You can see the slides I presented here.)

It turns out I was too conservative, as Netflix rose 90-fold in the next eight years...

5) I was supposed to fly home from Rome on Monday, but over the weekend my parents said, "Well, since you're in Rome, why don't you come down to Kenya and visit us?"

This is completely ridiculous since there are no nonstop flights – the two five-hour flights to Dubai and on to Nairobi plus a four-hour layover make it a longer trip than the nonstop from JFK – but of course, I said yes!

It's always great to see my parents, sister, and nephew, plus I'll get to attend his high school graduation on Friday, and have some adventures as well: We flew down to Amboseli National Park in my dad's plane to go on safari today and tomorrow, and are doing a "star safari" Saturday, camping out in the bush overnight with telescopes to see the stars and planets.

And, best of all, I'm loving on their two new puppies, who are one month old today! Here's a short video and picture of us with them: